capital gains tax canada vs us

A tax treaty eliminates double taxation of the same income. Canada allows capital gains to be taxed at half of the normal tax rate and grants a reduced tax rate on dividends paid by Canadian but not foreign corporations.

Understanding Capital Gains Tax In Canada

He pays 10 on the first 9950 income and 12 on the income he earned beyond that.

. Multiply 5000 by the tax rate listed according to your annual income minus any. That is why you receive a credit for taxes paid to the US on your Canadian tax return. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate.

Ad Tip 40 could help you better understand your retirement income taxes. Capital gains tax canada vs us. And the tax rate depends on your income.

For now the inclusion rate is 50. Youll owe either 0 15 or 20. The tax rate for these transactions is identical to the individuals marginal tax rate.

Marginal tax rates are composed of a federal component which is paid in the same amount by all Canadians and a provincial component which varies depending on which province you live in. The amount of tax youll pay depends on. Long-Term Capital Gains Taxes.

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. Canada Safeway Limited v. As a Canadian resident you are subject to tax on your worldwide income.

Capital Gains Tax Example Joe Taxpayer earned 35000 in 2021. Canada 1995 SCR 103 Capital Property or Business Income. In Canada 50 of the value of any capital gains is taxable.

In 1978 Congress eliminated the minimum tax on excluded gains and increased the exclusion to 60 reducing the. Up to 15 cash back You receive a credit for the taxes paid to the US on your Canadian tax return because you are a RESIDENT of Canada. All Major Categories Covered.

Property must also be included on your Canadian tax return. Download 99 Retirement Tips from Fisher Investments. The Queen 2014 TCC 208 Unsolicited Offers.

In our example you would have to include 1325 2650 x 50 in your income. Once you have realized your capital gains off of an investment asset you need to pay taxes on them as well. Her Majesty the Queen 2008 FCA 24 Primary and Secondary Intention.

If you are being audited for the sale of property call us today to see how we can help. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Income Tax vs.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the meaning of paragraph 3 in the United States except that such deduction need not exceed the amount of the tax that would be paid to the United States if the resident were not a United States citizen.

My answer takes into account the tax treaty. Canadian investors are forced to pay capital gains tax on 50 of their realized capital gains. Any gains or losses from the sale of US.

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Select Popular Legal Forms Packages of Any Category. The taxes in Canada are calculated based on two critical variables.

Get more tips here. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. However in Canada only 50 of your capital gains are taxable and you may be eligible to claim a foreign tax credit on income taxes paid.

From 1954 to 1967 the maximum capital gains tax rate was 25. The sale price minus your ACB is the capital gain that youll need to pay tax on. Canadian investors are forced to pay capital gains tax.

For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Canada Capital Gains Tax Calculator 2022

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Difference Between Income Tax And Capital Gains Tax Difference Between

Red China Taxes Capital Relatively Lightly Tax Foundation Tax Capital Gains Tax Countries Of The World

Capital Gains Tax Capital Gain Term

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Understanding Taxes And Your Investments

Difference Between Income Tax And Capital Gains Tax Difference Between

Sales Taxes In The United States Wikipedia The Free Encyclopedia Tax Sales Tax Capital Gains Tax

Calculating Taxable Gains On Share Trading In New Zealand

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Capital Gains Tax What It Is How It Works Seeking Alpha

Capital Gains Tax Or Income Tax Which Is Better For You Capital Gains Tax Income Tax Capital Gain

Capital Gains Tax What Is It When Do You Pay It

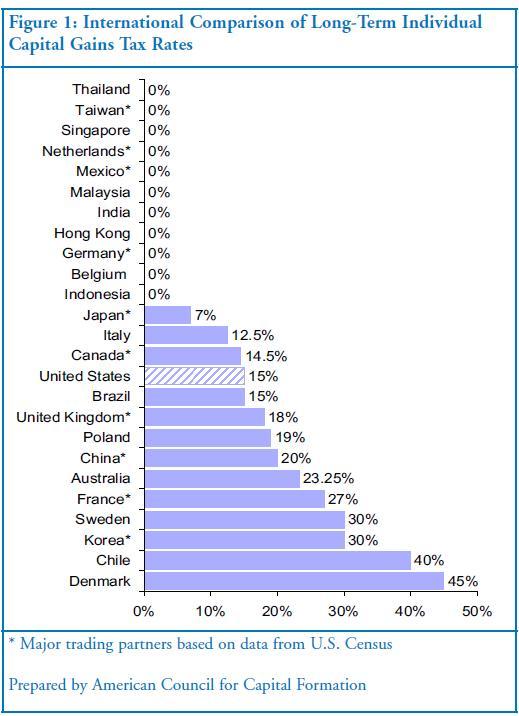

How High Are Capital Gains Taxes In Your State Tax Foundation